Gifts of Real Estate

Donate a valuable asset in exchange for powerful tax benefits and possibly an income stream for you and/or your loved ones.

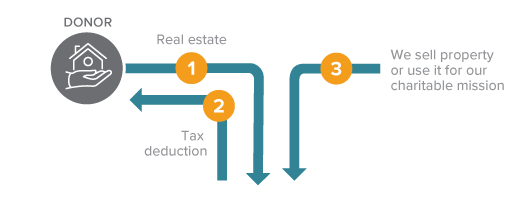

How It Works

- You deed your home, vacation home, undeveloped property, or commercial building to Smith College.

- Smith College may use the property or sell it and use the proceeds.

Benefits

- You receive an income tax deduction for the fair market value of the real estate.

- You pay no capital gains tax on the transfer.

- You can direct the proceeds from your gift to support the overall mission of Smith College.

Next

- You can donate your property yet continue to use it.

- More details about gifts of real estate.

- Frequently asked questions on gifts of real estate.

- Contact us so we can assist you through every step.

Contact Gift Planning

Planning your estate and legacy for future generations, including your charitable interests, takes careful evaluation. Consulting with the appropriate professionals can assist you.

Office of Gift Planning

Alumnae House

33 Elm Street

Northampton, MA 01063